Real estate investment can be a great way to secure your financial future and build wealth over time. Investing in a new and upcoming real estate project like D.I. Khan new city can be even more beneficial, as it offers the potential for high returns on investment. Here are five reasons why you should consider investing in the D.I. Khan new city real estate project.

High Potential for Capital Appreciation

One of the biggest advantages of investing in a new real estate project is the potential for capital appreciation. As the city and surrounding areas continue to develop and attract more residents, the value of the property is likely to increase. This means that, as an investor, you stand to make a substantial profit when you eventually sell the property.

The demand for housing in D.I. Khan is increasing as the city continues to grow, and the development of

D.I. Khan New City is well-positioned to meet this demand. This high demand for housing is likely to drive up property values in the area, making it a smart investment for those looking to make a return on their investment.

Additionally, the city’s economy is growing, with a number of industries, such as agriculture and manufacturing, driving economic growth. The development of D.I. Khan New City is expected to further boost the economy, creating new jobs and opportunities for residents. This economic growth is likely to have a positive impact on property values in the area, making it a wise investment for those looking to make a return on their investment.

Strong Rental Income:

Another reason to invest in the D.I. Khan new city real estate project is the potential for high rental income. As the city grows and attracts more residents, there will be greater demand for rental properties.

With the city’s population growing, the demand for rental properties is also increasing. This high demand for rental properties is likely to drive up rental rates in the area, providing investors with a steady stream of income from their investments.

As D.I. Khan continues to grow, the demand for housing will also increase. This presents an opportunity for investors to purchase properties in D.I. Khan New City and rent them out to residents. The city’s growing population and increasing demand for housing will help ensure a steady stream of potential tenants for rental properties.

State of the art Utilities:

When it comes to modern urban living, one of the most important factors to consider is the availability of standard utilities and amenities. That’s why the developers of D.I. Khan New City have made sure to include all the necessary utilities and amenities to ensure a convenient and comfortable lifestyle for residents.

One of the key features of D.I. Khan New City is its high-speed internet. With the increasing importance of the internet in our daily lives, it is essential for a city to have a reliable and fast internet connection.

D.I. Khan New City has made sure to provide its residents with a high-speed internet connection, ensuring that residents can stay connected and productive at all times.

Another important utility is the availability of phone lines. D.I. Khan New City has made sure that all residents have access to phone lines, ensuring that they can stay in touch with friends and family and conduct business as needed.

Of course, a reliable power supply is essential for any city. D.I. Khan New City has its own power grid and is connected to the national grid to ensure a constant supply of electricity. Additionally, the city has also implemented a number of energy-efficient measures, such as solar power generation, to reduce dependence on fossil fuels and minimize carbon emissions.

Clean water is another essential utility, and D.I. Khan New City has made sure to provide its residents with a safe and clean water supply. The city has its own water treatment plants that purify and supply water to the entire city. The water is tested regularly to ensure that it meets the highest quality standards. Additionally, the city has also implemented a number of water conservation measures, such as rainwater harvesting, to ensure that the water supply is sustainable for the future.

The sewage system is also an important part of the city’s utilities. D.I. Khan New City has a modern sewage system that effectively collects and treats wastewater. The city has its own sewage treatment plants that purify the wastewater before it is released back into the environment. This ensures that the city’s wastewater does not pollute the surrounding areas and protects the health of the residents.

D.I. Khan New City has been designed to provide its residents with all the necessary utilities and amenities to ensure a convenient and comfortable lifestyle. From high-speed internet and phone lines to a reliable power and water supply and a modern sewage system, the city has everything residents need to live a modern and comfortable urban lifestyle.

Quality Construction and Amenities:

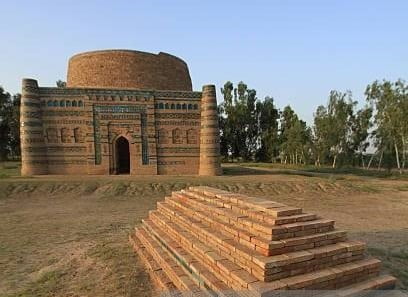

D.I. Khan New City is designed to be a modern and sustainable community with a wide range of amenities for residents. This includes high-quality construction, parks, recreational facilities, shopping centers, and schools. These amenities are designed to improve the quality of life for residents, making it an attractive location for those looking to invest in real estate.

High-quality construction is a major selling point for any real estate project, and D.I. Khan New City is no exception. The developers of this new city have ensured that all properties are built to the highest standards, using durable materials and modern construction techniques. This ensures that the properties will be able to withstand the test of time and provide a comfortable living experience for residents.

Parks and recreational facilities are an important part of any community, and D.I. Khan New City is designed to provide residents with plenty of opportunities to enjoy the outdoors.

The city will feature well-maintained parks and green spaces where residents can relax, play, and socialize. Additionally, the city will also have recreational facilities such as sports fields and community centers where residents can engage in a wide range of activities.

Shopping centers and other commercial developments are also an important part of D.I. Khan New City. The city will feature a variety of shops, restaurants, and other businesses where residents can shop, dine, and enjoy their free time. This will create a vibrant and bustling community that will be a great place to live and work.

Finally, D.I. Khan New City will feature a variety of educational facilities, including schools and universities. This will provide residents with access to high-quality education and will attract families and young professionals to the area.

Special Economic Zone

One potential reason to invest in a real estate project in DI Khan New City could be the presence of a Special Economic Zone in the area. Special Economic Zone is designated areas that have more relaxed regulations and tax incentives compared to the rest of the country, which can make them attractive to businesses and investors. The presence of a Special Economic Zone in DI Khan New City could mean that there is increased economic activity and growth in the area, which could lead to a higher demand for housing and commercial properties. Additionally, the relaxed regulations and tax incentives within the SEZ could make it more profitable for real estate developers to build and operate in the area.

D.I. Khan is home to a growing economy, with a number of industries, such as agriculture and manufacturing, driving economic growth. The development of D.I. Khan New City is expected to further boost the economy, creating new jobs and opportunities for residents. This economic growth is likely to

have a positive impact on property values in the area, making it a wise investment for those looking to make a return on their investment.

The strong economic growth in D.I. Khan is being driven by a variety of factors, including the city’s strategic location and growing population. The city is located at the crossroads of major transportation routes and is easily accessible from other major cities in the region. This makes it an ideal location for businesses looking to set up operations in the area.

The city’s growing population is also playing a key role in driving economic growth. As the population grows, so does the demand for goods and services. This creates new opportunities for businesses to set up shops in the area, which in turn creates jobs and drives economic growth.

The development of D.I. Khan New City is also expected to have a positive impact on the economy. The construction of new homes, commercial developments, and infrastructure projects will create new jobs and stimulate economic growth. Additionally, the presence of modern amenities such as parks, recreational facilities, and shopping centers will attract more people to the area and create more opportunities for businesses to thrive.

D.I. Khan New City presents an opportunity for investors to benefit from a strong economic outlook. The city’s growing economy, strategic location, and growing population are expected to drive economic growth, which in turn is expected to drive up property values in the area. This makes it an attractive location for those looking to invest in real estate and make a return on their investment.

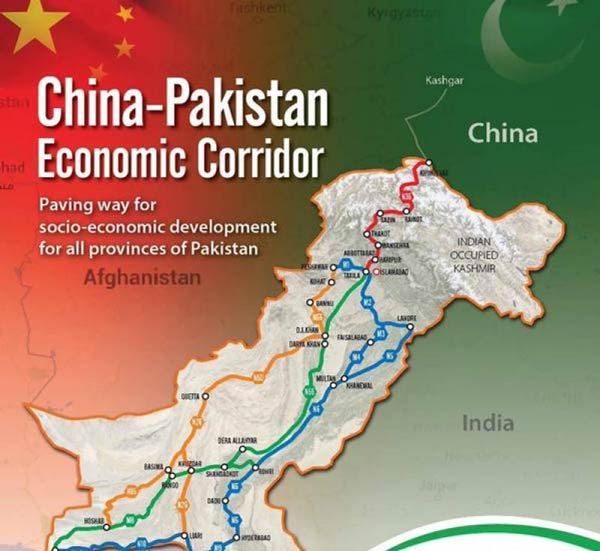

Investing in Dera Ismail Khan’s new city can provide a number of benefits. One of the main benefits is its proximity to the China-Pakistan Economic Corridor (CPEC) Western Route. The CPEC is a massive infrastructure and development project that aims to connect Gwadar Port in Pakistan’s Balochistan province with China’s Xinjiang region. The Western Route of the CPEC runs through Dera Ismail Khan, making it a strategically important location.

Investing in the new city of Dera Ismail Khan would give investors access to the economic opportunities created by the CPEC. As more and more businesses and industries move into the region to take advantage of the improved connectivity and infrastructure, there will be a growing demand for housing, commercial spaces, and other real estate developments. This could lead to a significant appreciation in property values, providing investors with a strong return on their investment.

Another benefit of investing in Dera Ismail Khan’s new city is the proximity to the Kallur Kot bridge. The kullurkot bridge will be connected to the CPEC Western route from Abdul Khel Interchange by a 45 KM long dual carriage way passing through Dhakki Mour, traversing from DIKNC at a distance of 3Km

This makes the new city of Dera Ismail Khan an attractive location for businesses and industries looking to take advantage of the improved connectivity and accessibility.

Conclusion:

In conclusion, investing in the D.I. Khan new city real estate project offers a number of benefits. With a high potential for capital appreciation, strong rental income, State of the art utilities, quality construction and amenities, and a strong economic outlook, it’s a smart financial decision that can help you secure your financial future and build wealth over time. It’s always a good idea to research a real estate project thoroughly before investing and consult with experts in the field to make an informed decision.